Out on the campaign trail, there are a couple of competing narratives about what’s going on with the Kansas budget.

Both acknowledge that plummeting revenues have delayed road projects, increased the state’s bond debt and forced cuts in higher education, healthcare and safety net programs for poor Kansans.

But that’s where the stories diverge.

Moderate Republicans and Democrats running for the Legislature are blaming the 2012 income tax cuts championed by Governor Sam Brownback for crashing the state budget.

Democrat Adrienne Olejnik made that case early and often during a recent candidate forum on Emporia radio station KVOE.

“The top priority as we all know is the financial cliff that Kansas is now on,” says Olejnik. “We have to re-evaluate the 2012 tax changes because they have proved to be nothing but a disaster for our state.”

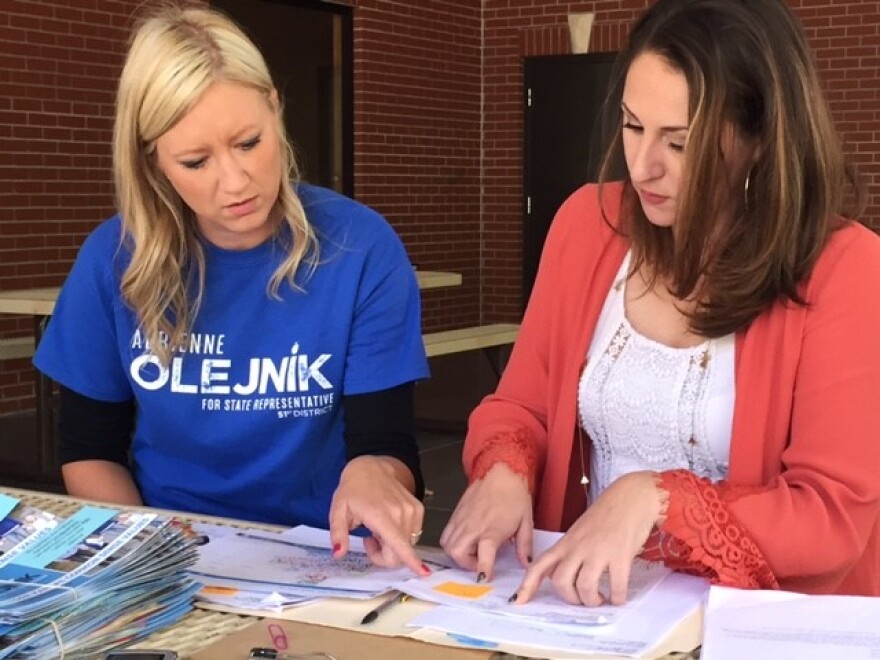

Olejnik, the director of the Rossville Public Library, is just one of the upstart candidates across the state challenging incumbents on this issue. On the surface she looks like a longshot to win, running in the 51st House District, which covers parts of five Flint-Hills counties where Republicans outnumber Democrats roughly three to one.

But as she knocks on doors Olejnik says she’s being greeted by a surprising number of Republicans who agree with her about “the mess” in Topeka.

“People are frustrated, especially with the LLC exemption,” Olejnik says, referring to the income tax exemption the 2012 law gave more than 300,000 business owners.

“That comes up quite often,” she says. “(Voters) recognize there are groups of people and individuals who are not paying their fair share and yet the person at the door, their taxes are going up.”

In 2015, Brownback and lawmakers raised sales and tobacco taxes to stabilize revenue collections and balance the budget. Spending cuts at the state level also have forced counties, cities and school districts to raise property taxes to maintain services.

Kenneth Kriz, a professor of public finance at Wichita State University who has studied the impact of income tax cuts on the economies and budgets of states, says there is a direct connection between the income tax cuts and the state’s plummeting revenues. He says the first full year after rates were reduced, revenues dropped by $700 million.

“We’ve never recovered the $700 million in lost revenue,” Kriz says “And every year that goes by we fall farther behind where we would have been under the existing tax code as of 2012.”

If rates had not been reduced, Kansas would be collecting approximately $920 million more in income taxes in the current fiscal year, according to estimates compiled by the Kansas Legislative Research Department.

Conservative Republicans are telling a different story.

“There are a lot of things that have happened that are beyond our control,” says Republican Rep. Ron Highland, from Wamego, the incumbent Olejnik is challenging.

Highland says that macro-economic forces are the reason the tax cuts that he supported haven’t generated the shot of adrenaline that both he and Brownback anticipated.

“The situation has been exacerbated by the economy, both national and international and again in our state, especially here in the Midwest with the falling agricultural commodity prices and the cattle prices,” Highland says.

Highland’s explanation tracks with the talking points that Brownback is also using. When he appeared recently on Joseph Ashby’s conservative talk radio show in Wichita, Brownback said: “We’ve got in essence a commodity led rural recession going on in the state, It’s low oil prices, low gas prices, it’s low agricultural commodity prices.”

Kriz says the agriculture, energy and aircraft manufacturing sectors of the Kansas economy are facing “some headwinds.” But, he says, they are not the main cause of the state’s ongoing budget problems, which, he notes, started several years ago when oil and crop prices were much higher.

“It’s quite possible that there are other factors that are causing kind of marginal changes, a little bit of weakness in revenues,” Kriz says. “However, one can’t get past the fact that individual income tax revenues fell by 25 percent. And, that’s a big hole.”

When it comes to how to fill that hole, candidates from both parties appear to agree on one thing: The need to revisit one of the most controversial features of the tax cuts – the exemption given to business owners.

Olejnik says it should be repealed. Highland isn’t that definitive, saying it’s something that lawmakers “need to take a close look at.”

“The concept was to encourage businesses to grow,” Highland says. “The problem is we didn’t put in a stratification where if you grew your business so much we gave you a little tax break. We just had a blanket (exemption).”

Repealing the so-called LLC exemption would generate between $200 million and $250 million. That’s well short of what most think will be needed to close the hole. Depending on what the Kansas Supreme Court orders in a pending school finance lawsuit, some officials say the state may need up to an additional $1 billion to fully fund next year’s budget.

That means even if control of the Legislature shifts from conservative to more moderate Republicans, members may once again be forced to choose between raising taxes, cutting spending or doing some of both to keep the budget in the black.

Jim McLean is executive editor of KHI News Service, which is a partner in a statewide collaboration covering elections in Kansas. Follow Jim on Twitter @jmckhi.